Fiscal Position in Odoo

In Odoo, fiscal positions are used for replacing default taxes configured in products. The replacement shall be customer specific, provided, the customer is configured with a fiscal position. The mapping related to the replacement or swapping would be defined in the fiscal position record.

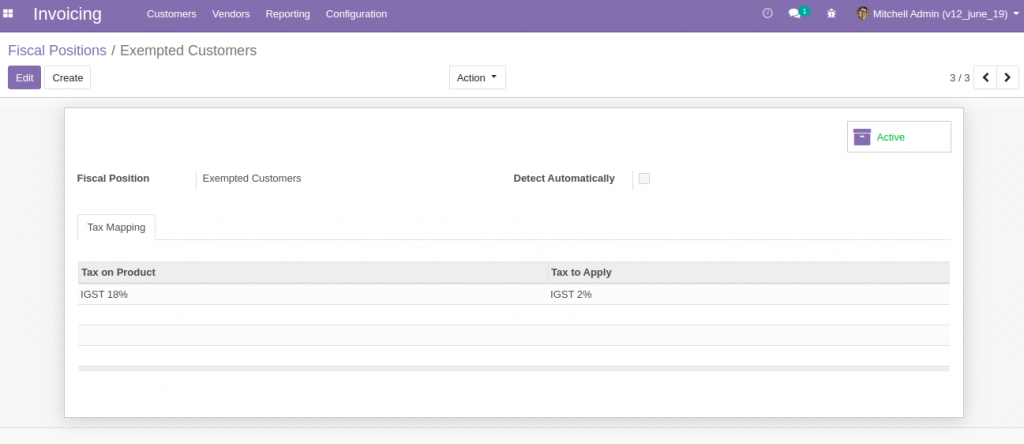

Fiscal Position

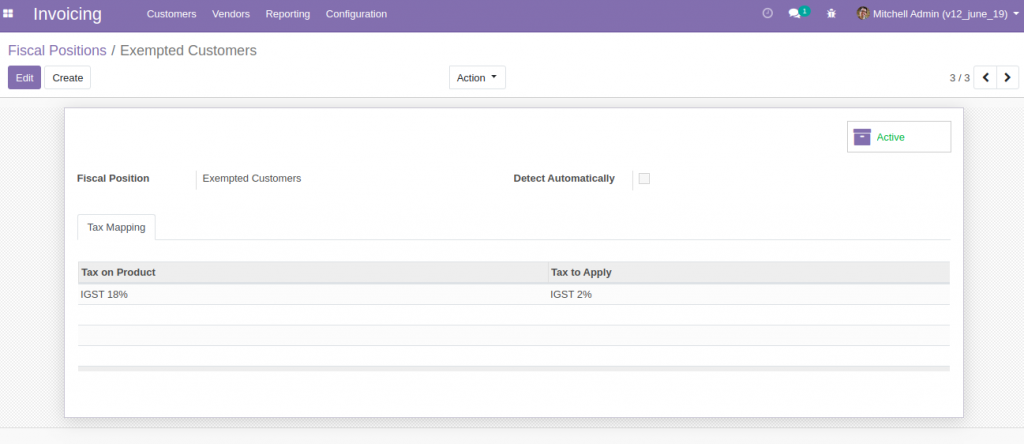

Menu : Invoicing > Configuration > Accounting > Fiscal Position

A fiscal position record allows swapping of taxes defined in product record, while creating sales order for the product.

In the above example, the fiscal position record is configured to replace the 18% tax with 2% tax.

Entities involved in the process flow are the following

- Product

- Customer

- Tax

- Fiscal Position

- Quotation/Sales Order

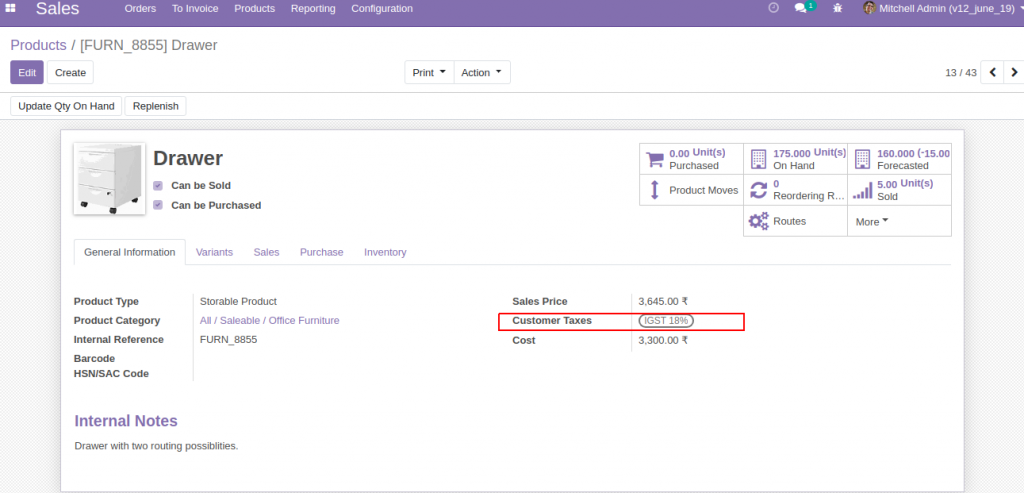

Product

‘[FURN_8855] Drawer’ is the product considered here. Customer tax of the product is IGST 18%

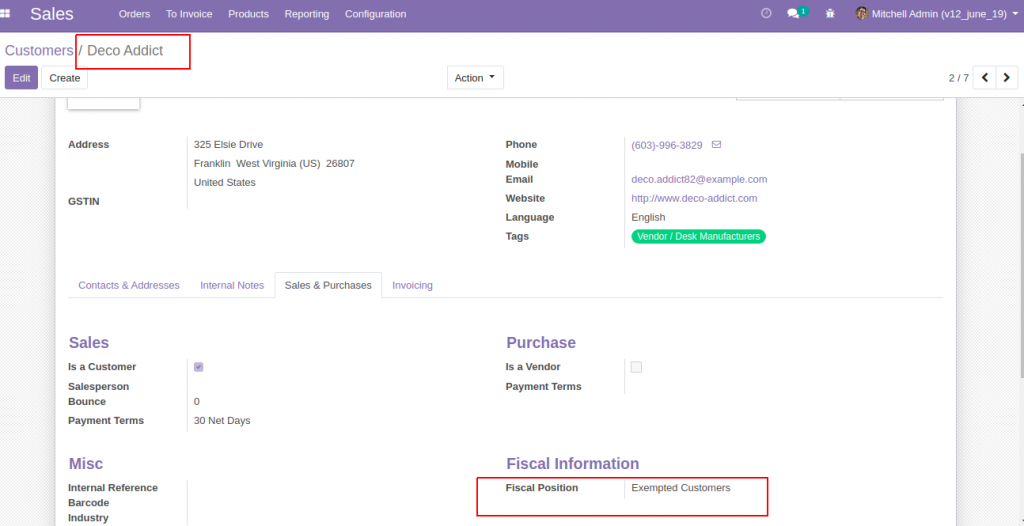

Customer

The customer considered, ‘Deco Addict’, is configured with the fiscal position we created, which is ‘‘Exempted Customers’

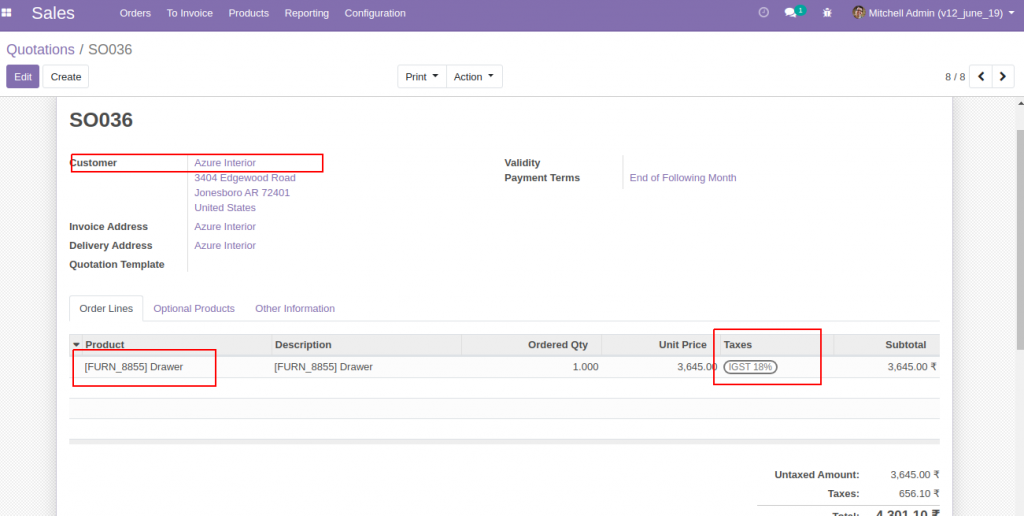

Order 1

First, we are creating an order for a customer who is not configured with any fiscal positions. Product is ‘[FURN_8855] Drawer’ whose customer tax is IGST 18%. The order line takes the tax configured in product.

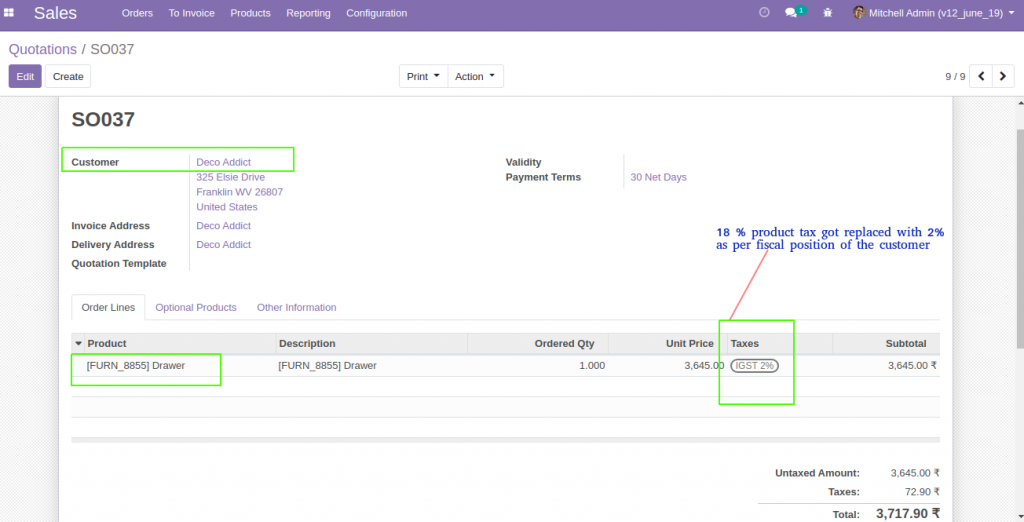

Order 2

Order is created for customer ‘Deco Addict’, who is configured with the fiscal position we created, which is ‘‘Exempted Customers’. Order line Product is ‘[FURN_8855] Drawer’ whose customer tax is IGST 18%. But here, the order line takes the replacement tax configured in the fiscal position ( ‘IGST 2%’ ) instead of using the tax defined in the product.

The logic behind the tax replacement lies completely on the fiscal position record.

The feature is useful when we have customers who enjoy tax benefits due to special zone operations.